An economic externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of economic activities. They are unpriced components of market transactions. An example is the gasoline you buy. Burning the gasoline causes pollution that harms other people including those who do not own cars, future generations, and it harms the environment including animals. Society incurs a cost from that pollution that you don’t pay for at the pump. The gasoline producers and vendors do not pay for it either. Unless you add a tax or make other adjustments the act of polluting is free of charge, even though there is a real cost associated with it. It is a cost that is invisible to unfettered “free markets”. It is a market failure. Note I am putting “free markets” in quotes because the free market does not exist all by itself. It exists within a framework of societal norms, culture, laws, a banking system, and entities such as limited liability corporations, etc.

The existence of economic externalities is entirely uncontroversial among economists, including laissez-faire (libertarian) economists such as Milton Friedman, Friedrich Hayek, and Ludwig von Mises, even though Ludwig von Mises said that they arise from lack of “clear personal property definition.” In fact, Milton Friedman, Nobel prize winner in economics, and leading anti-tax champion, stated that pollution met the test for when government should act, but that when it did so, it should use market principles to the greatest extent possible — as with a pollution tax. However, in my experience the existence of economic externalities is unwelcome news to market fundamentalists who lack education in economic science, including many libertarian leaning politicians. If you bring up the subject you might be dismissed, scoffed at, or labeled as a leftist. I don’t have a Gallup poll to back this up, but I believe it is correct to say that economic externalities are controversial among significant portions of the public despite being a universally accepted and fundamental concept of economic science.

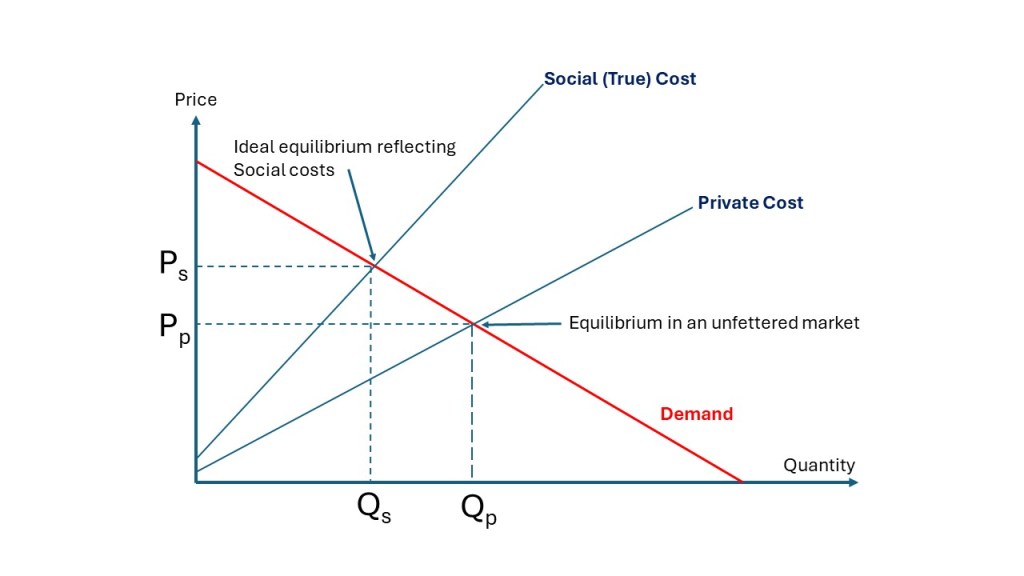

In the simple supply-demand graph above we see how the price of a product per unit (private cost / or production cost) increases with the increased quantities produced. The increase in price could be because resources become increasingly scarce as more must be produced. The curves are typically not simple straight lines like this. It is just an illustration. As the price goes up demand goes down (the red demand curve/line) because fewer people want to buy the product or can afford the product. An equilibrium is reached where the curves meet. According to classical economics (micro-economics classes, or macro-economics classes) this equilibrium represents the optimum benefit for society assuming consumers and producers are perfectly rational (with respect to their self-interest) and there are no externalities.

Unfortunately, in this example, there is an externality and as we know the unfettered free market does not account for it. Let’s say that we know the cost of the externality and we find a way of adding that cost to the price, perhaps via a tax. The price is higher and fewer units will be sold and we have a new equilibrium. Now the economically optimal point is the ideal equilibrium that reflects social cost. In the 1920’s an economist Arthur Pigou argued that a tax, equal to the marginal damage or marginal external cost on negative externalities could be used to reduce their incidence to an efficient level. Notice this tax is not for redistributing wealth or bringing revenue for the government but to reduce economic harm to society. There are other ways to address the problem, but this type of tax is called a Pigouvian tax.

Finally, I would like to give a few examples of negative and positive externalities. Negative externalities could be :

- Pollution

- Climate Change

- Depletion of fish due to overfishing

- Depletion of other resources

- Overuse of antibiotics

- Spam email

Some positive externalities are :

- A beekeeper keeps the bees for their honey, but a side effect or externality is the pollination of surrounding crops by the bees.

- Education (societal benefits beyond the individual).

- Research and development

- Innovations

- Scientific discoveries

- Vaccination

As I previously mentioned I would like to launch a second blog featuring small facts or insights that are widely disbelieved despite being known to be true by the experts in the relevant field or facts that are very surprising or misunderstood by a lot of people. These facts shouldn’t be trivia but important facts that are somewhat easy to understand despite their status as being unthinkable to many. They are not scientific theories or complex sets of facts or information, but facts that you can easily state. I’ve decided to call these facts super facts (is that a stupid name?). This is the last super fact I am posting on my Leonberger blog. I will create a list of hundreds of super facts but that is for my upcoming blog. To see the other four super fact posts so far check the list below:

- My second blog idea

- Some Things are not Meant to be Known

- We Know That the Earth is Billions of Years Old

- The Speed of Light In Vacuum Is a Universal Constant

Had you heard of economic externalities before reading this?